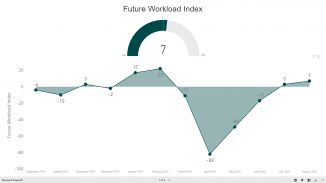

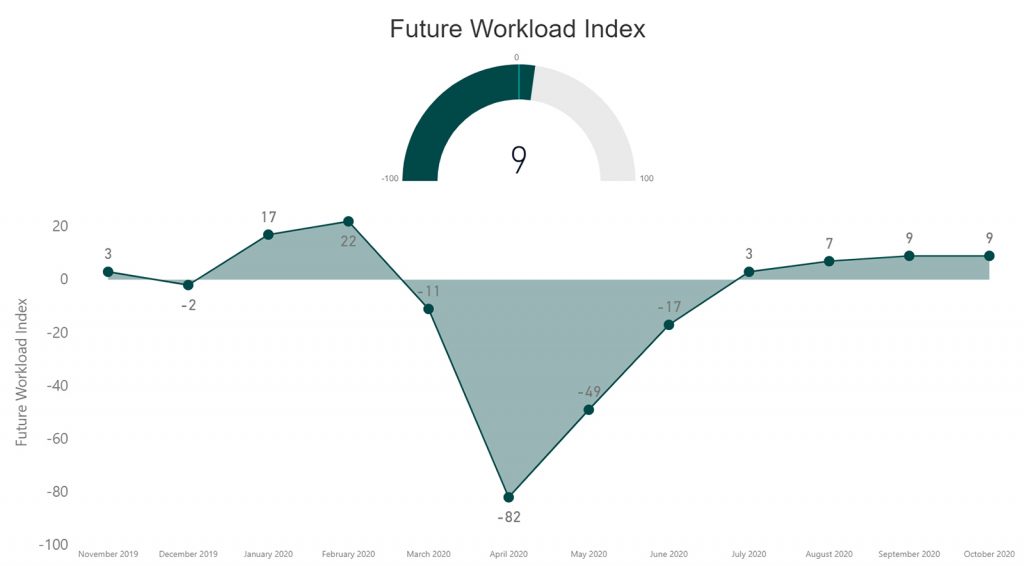

In October, prior to the announcement of a second lockdown in England, the RIBA Future Workload Index held steady, again returning a balance figure of +9. Practices are expecting workloads to increase in the coming three months. 30%of practices expect an increase in workload, 21% expect a decrease whilst 49% expect them to remain the same.

Confidence has been slowly growing among practices of all sizes, with medium and large practices returning positive balances and a notable increase in positivity compared with September. Reports of personal underemployment are decreasing, and workload levels continue to be on the up. The outlook for future staffing levels is also improving. Workloads now stand at 90% of what they were a year ago.

This improving picture is a result of a strengthening private housing market and optimism about future work for practices outside the capital.

London remains the least positive region, with concerns about future profitability: 12 % of London practices expect falling profits to threaten practice viability, compared to the national average of 6%.

However, workload confidence is markedly increasing in the South and London: the South of England has posted a balance figure of +16, up from -2 in September. London only just remains in the negative about future work, this month posting a balance figure of -1 – the eighth successive negative figure from the capital, but the highest balance figure since March 2020.

Wales and the West remains the most positive area, with a balance figure of +25, although this is down from September’s high of +40. The North of England remains positive and consistent, posting a workload balance figure of +19. The Midlands & East Anglia have slipped back into negative territory, dropping 17 points to post a balance figure of -7 this month.

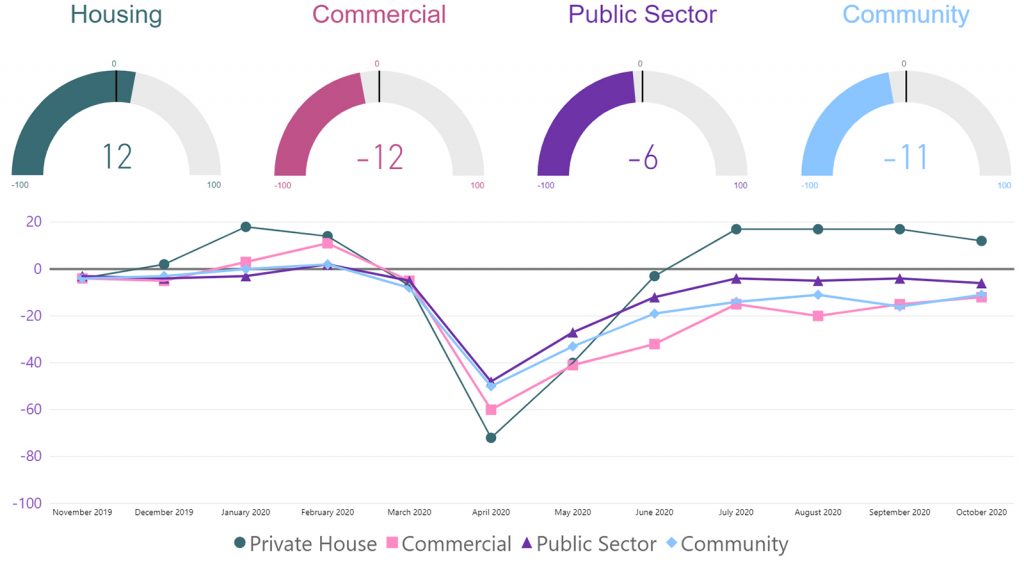

Among the four different work sectors, private housing continued to be the only area anticipating growth – returning a balance figure of +12, softening slightly from last month’s figure of +17. The commercial sector continues its slow recovery, rising 3 points to -12 and the community sector rose 5 points to -11, up from -16. The public sector rose by one point to -4.

In terms of staffing:

- Returning to positive territory for the first time since February, the RIBA Future Trends Staffing Index rose four points to reach a balance figure of +1 in October.

- The anticipated demand for temporary staff is also on the up. The temporary staffing index also went into positive territory, with a balance figure of +4 (up from 0 in September and -2 in August)

- 81% of practices overall expect permanent staffing levels to remain consistent (an increase of 5% from September)

- 9% expect to see a decrease in the number of permanent staff over the next three months (down from 15% in September).

- 10% expect permanent staffing levels to increase (up from 8% in September)

- Medium sized practices are those most likely to need more permanent staff.

- In London, the balance figure for permanent staff is -8 (up from -19 in September), with 15% of practices expecting to be employing fewer staff in the next three months (although that’s less than the 22% of practices in September).

- In Wales and all other UK regions, permanent staffing levels are expected to increase.

- Personal underemployment is also falling; at 20% (down from 25% in September) it is at the levels we were seeing immediately before the pandemic hit.

- The number of staff on furlough has also decreased; 6% this month compared to 9% in September, and 22% in May.

- Staffing levels are 97% of what they were 12 months’ ago (up from 94% last month). Overall, 3% have been made redundant since the start of the pandemic, though 19% are working fewer hours.

RIBA Head of Economic Research and Analysis, Adrian Malleson, said: “These results are showing a slow but steady positive increase in terms of workload and staffing. There is, however, much regional variation and London practices have more concern about future profitability and workload than elsewhere in the country.

“The next few months will be critical for UK architects. How the government negotiates Brexit, how the pandemic is managed, and how government spending promises are realised will all directly affect architects’ workload. The extension of the furlough scheme into 2021 has stayed the potential budget crisis of increased salary cost without any commensurate increase in revenue.

“The commentary received in October suggests a rise in enquires and commissions, particularly for smaller residential projects. Others describe particular difficulties with work in the hospitality sector, in particular, stalling.

“There remain significant concerns about the course of the pandemic and the lack of clarity on Brexit. We continue to be on hand, providing support and resources to our members as they navigate these challenging times.”