Akshay Thaman, IP Analyst at IP specialists GovGrant, provides insight into the latest HMRC data and what it means for construction.

Innovation taking place across the construction industry means businesses in the sector stand to gain significantly from the UK government’s Patent Box scheme. Data from the Innovation Nation survey found that 92% of companies in engineering and building felt they were between somewhat innovative and highly innovative. However, HMRC data shows that few are capitalising on their innovation through patenting.

In the 2018-19 period, there were 3,125 claims made for R&D tax credits, proving companies in the sector are taking the first steps towards capitalising on their innovation. Yet there have been just 30 Patent Box claims from construction firms in the same timeframe, so far.

Comparing the construction sector to other industries in the UK, it’s clear that construction companies are somewhat behind the curve. The manufacturing sector has the most Patent Box claims of any sector: the construction industry has less than 5% of its claims. At second place in the list is the wholesale & retail trade, repairs sector, with the construction industry only making 12.5% of its claims.

As with other industries, it may be that construction companies simply aren’t aware that innovation can be small and simple – it’s not just for digital sectors or ‘lab coat’ industries. Even a tweak to an existing process to make it more efficient could be qualifying R&D. In addition, the patenting process is often misconceived as being more complex and involved than it actually is.

What’s the scale of the opportunity for businesses in the construction sector?

The construction sector has barely scratched the surface of its potential when it comes to making the most of Patent Box. The figures show not only a relatively small number of claims, but high financial returns for those businesses which successfully completed the process. An average Patent Box claim so far in 2018-19 is worth £806,504.

It’s not just for large companies either – 76% of the companies claiming Patent Box tax relief are SMEs. It opens a potential source of untapped funding for UK SMEs and could hold the key to building back better after Covid-19. A successful Patent Box application can reduce an SME’s corporation tax on profits by 44%, on average. The average SME Patent Box claim for 2018-19 stands at £106,667 so far.

Deep-rooted and broad misconceptions around the nature of patenting continue to drive a slow rate of Patent Box claims in construction.

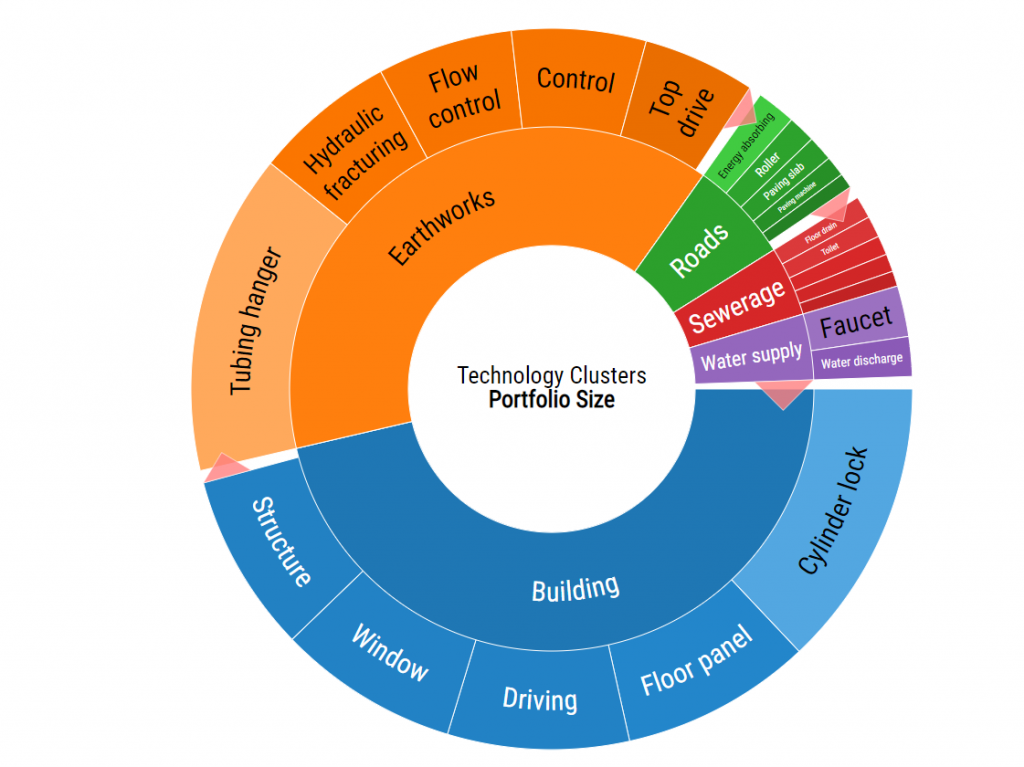

Which technologies are most patented in the construction sector?

Which SME construction companies are patenting successfully?

Despite the reluctance of some in the industry to embrace patenting, many construction SMEs are seeing great results from it. Salamander Solutions (heating) and Deep Sea Mining Finance, for example, have achieved impressive value from their patents.

With companies such as McAlpine & Co (plumbing), Ardyne Holdings (oil) and Hesco (defense and security suppliers) all holding patents, the variety of businesses capitalising on their innovations is clear to see.

The chart below features companies holding fewer than 50 patents and highlights the ability of SMEs to create value from patenting.

Q&A section for Patent Box articles

Why are SMEs missing out?

Inactivity around Patent Box across the construction sector may be fed by the misconception that patenting is a costly and time-consuming legal process, whose sole benefit is to protect against IP theft.

It’s also a common false belief that patentable innovations have to be traditional ‘inventions’, rather than simply innovative ideas or processes. GovGrant research shows 83% of SMEs see the importance of commercialising IP, yet only 24% think this is the main point of a patent. However, this perception is slowly changing.

Which commonly perceived barriers stop companies from claiming?

Patentable innovation is taking place right across the sector. Construction companies claiming R&D tax credits simply need to ask themselves whether they are eligible to take the logical next step of claiming through the Patent Box scheme.

The process of innovation is a continuum, and R&D tax credits are only the start – identifying intellectual property (IP) follows, culminating in a patent and a Patent Box claim and the significant financial benefits it can bring. However, the HMRC data suggests that SMEs are, regrettably, stopping after one step.

Finding the patentable IP is rarely a case of covering a whole product or service. It’s about identifying that single blade of grass in the first instance, rather than harvesting the entire field. A single patentable innovation can create financial benefits right across the business.

How can a company better identify innovations for Patent Box?

GovGrant is working not only to raise awareness of the wide-ranging benefits of Patent Box, but helping companies of all sizes to identify their patentable IP assets quickly, efficiently and accurately. This is part of the wider process, starting with R&D tax credits, where we guide companies through every possible avenue of claiming tax benefit from their IP – however small or hidden that valuable gem of an innovation may be.

Construction businesses could be missing out on significant tax benefits. These apply to worldwide revenues for multinational businesses where the patent has been granted in the UK. The purpose of applying for Patent Box is not to draw your company into a long, drawn-out legal process, but to pinpoint where IP is patentable right from the start, often through a detailed R&D tax report. Taking the time to recognise these areas can have a big financial impact in the long run.