The Royal Institute of British Architects (RIBA) has published the latest Future Trends survey results, a monthly report of the business and employment trends affecting the architects’ profession.

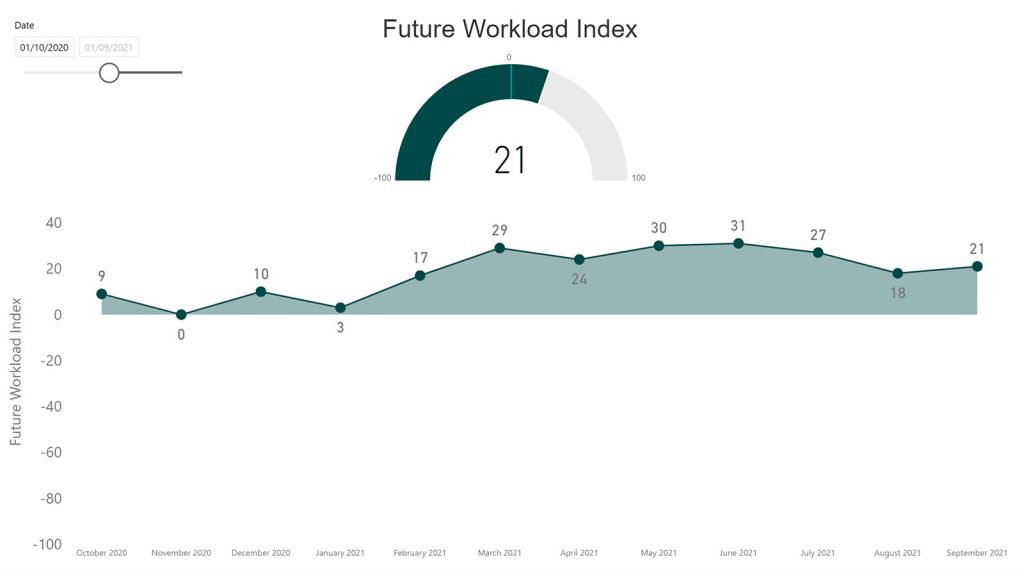

In September 2021 the overall RIBA Future Trends Workload Index firmly in positive territory and rose slightly, with a balance figure of +21. This is a three-point increase on August’s balance figure of +18 and an 8 point increase on September 2020. Despite growing external challenges, optimism about future workloads is holding firm.

At the start of the pandemic, there was deep concern that practices would have to lose staff. Practices turned to the furlough scheme to protect jobs. In July 2020, practices reported 20 per cent of staff being on furlough. It was unclear whether those staff would have jobs to return to when furlough ended.

This month’s Future Trends suggests that practices now face a different challenge. As the furlough scheme ends, only 1 per cent of practices expect to be unable to retain returning staff. None expects to be making additional redundancies. Instead, the picture is one of relative shortage. Almost a fifth of practices (18%) report having difficulty recruiting staff. The issue is particularly acute among large and medium-sized practices (11 – 50 and 51+ staff), with over 40% reporting difficulty recruiting staff. A lack of European candidates is exacerbating the recruitment challenge.

On balance, all regions and practice sizes remain confident about future workloads. Workload growth is expected in three of the four monitored sectors, (housing, commercial and public) with only the community sector expected to contract. However, concerns about shortages of materials and labour continue. These shortages are feeding project cost inflation so making current projects exceed budget, and future projects potentially unviable.

In terms of practice size the outlook of small practices (1 – 10 staff) remains optimistic at +19, up from +16 in August. Confidence among large and medium-sized practices (11 – 50 and 51+ staff) remains very strong at +34, down two points from August’s +36.

For the seventh successive month, all regions expect workloads to grow over the next three months. Whilst some regions are growing in optimism this month, others have seen a marked fall. The South East has seen a 16 point drop from +20 in August, to +4 in September and the Midlands & East Anglia seeing 14 point drop in from +17 to +3.

By contrast optimism in London has increased this month by 14 points in September to +26, from +12 in August. The North of England (+41) and Wales & the West (+28) are increasingly confident about future workload.

Confidence in the four monitored sectors has either held steady or improved slightly. In September, the private housing sector posted a balance figure of +23, up from +21 in August. The commercial sector held steady this month to again return a balance figure of +10. The public sector recovered from last month’s dip into negative territory, with a balance figure of +5. Only the community sector remains in the doldrums with another negative balance figure this month (-1). It is now 19 months since the sector saw a positive balance figure.

In terms of staffing:

- At +10, the RIBA Future Trends Permanent Staffing Index rose by three balance points in September

- Overall, 15% (up 4% from August) of practices expect to employ more permanent staff over the coming three months, whilst 5% expect to employ fewer (1% increase). 79% expect staffing levels to stay the same.

- In September, personal underemployment fell to 12% and is at its lowest level since October 2017.

RIBA Head of Economic Research and Analysis, Adrian Malleson, said: “Overall, the September Future Trends survey continues to show broad-based confidence among the profession, with an uptick on last month’s balance figure.

“Positives include a strengthening market in the capital, improving employment opportunities, little chance of widespread redundancies as furlough ends, and a recovery extending beyond Private Housing into the commercial sector. Workloads continue to be up on a year ago. Many practices continue to report a full pipeline of projects; some have a client waiting list.

“Nevertheless, challenges remain. Construction product shortages and price inflation make managing project costs and scheduling exceptionally challenging. There are also reported shortages of unskilled labour, tradespeople, and qualified architects. The issue of obtaining adequate and affordable PII remains.

“RIBA is reporting findings to government and working with other bodies in the built environment to monitor ongoing trends. We continue to be on hand, providing support and resources to our members.”