The new report from IDTechEx, “Electric Vehicles in Construction 2023-2043”, shows that there are many reasons to adopt an electric vehicle as a construction professional: they are quieter than diesels, they help with air quality in the construction site, they can be more precise and easier to operate, and so on. But one key factor will determine whether electric machines become the default choice for construction or a greenwashing gimmick – total cost of ownership (TCO). The good news is that IDTechEx’s research finds that at current battery pricing the TCO should soon be tipping in favour of the electric vehicles.

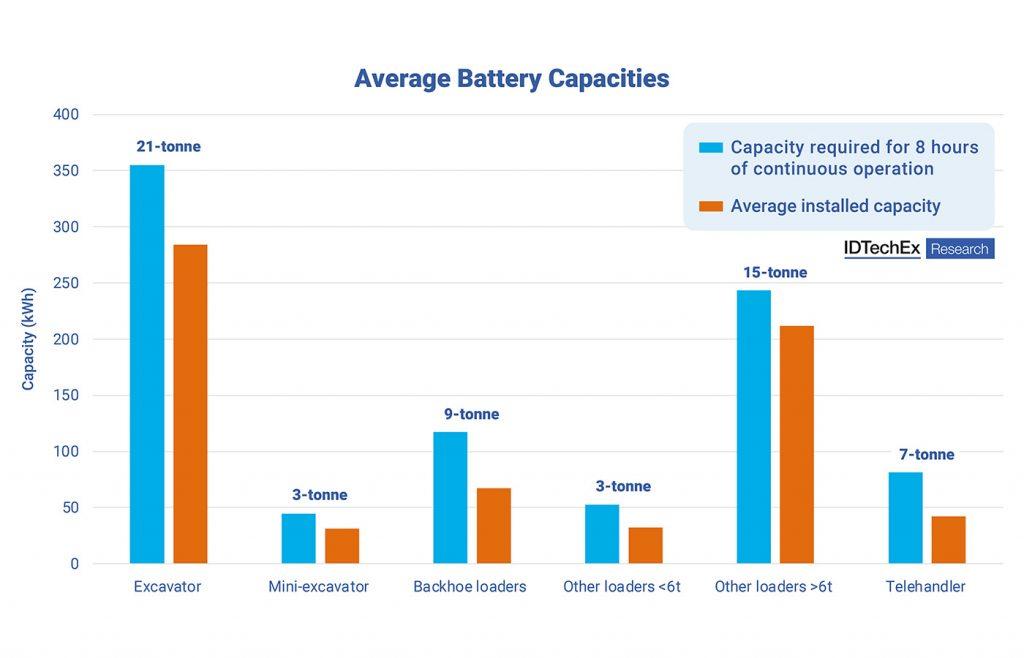

In terms of performance and capability, there is little doubt that an electric construction machine will be as productive as its diesel counterparts. The data that IDTechEx has collated through its research shows that much. However, the endurance of the machines and their ability to complete long, arduous days is still questionable. IDTechEx’s research shows that the average electric machine will fall short running a continuous 8-hour day. This can be mitigated with fast charging, tethering, or even battery-swapping options. Even so, the batteries going into these vehicles are still big – really, really big. To get adequate endurance from something like a 23-tonne wheel loader or a 27-tonne excavator, manufacturers are installing battery packs with capacities in the hundreds of MWh, with some stretching as far as 700MWh, the equivalent of nearly 12 Tesla Model 3s. These batteries are going to be the bulk of the premium of building an electric machine. Even at automotive prices, 700MWh is going to cost around $70,000. The critical question is – will this be repaid in fuel savings and reduced maintenance?

For the car industry, it is well-accepted that the running cost of an electric vehicle is low enough to outweigh the initial premium associated with buying the car. This has a lot to do with the cost of batteries continuing to fall. For large-volume vehicle production, OEMs can expect to pay in the region of $100/kWh for lithium-ion batteries. There is little difference between electric vehicles and internal combustion equivalents at this price. However, the same can’t be said for the construction industry yet.

Even for small construction vehicles, like 2-tonne excavators, the electric machine can be as much as twice as expensive as the internal combustion option. However, with a diesel excavator consuming around 2.5L per hour in fuel, there is still an opportunity for TCO savings. Moving to large excavators, the savings become even greater. Although excavators can get as large as 100 tonnes or more, the majority of electric excavators go up to around 30 tonnes, with the odd example in the 40s and 50s. Even at these more modest sizes, the potential fuel savings are huge. The analysis in IDTechEx’s report “Electric Vehicles in Construction 2023-2043” shows that the average 30-tonne excavator will consume around $18,000 per year in fuel. However, the equivalent electric machine would cost around $9,400 in electricity, a little over half, or a saving of around $8,600 per year. Over the vehicle’s lifetime, say 12 years, that’s more than $100,000 saving before maintenance. However, a machine this size will likely need a 350-450kWh battery pack to give adequate endurance. Reaching the right cost per kWh will be essential for making the transition worthwhile.

Lots of initial electric construction vehicles came from retrofitting normal ICE machines with electric powertrains. This was an inherently expensive process. Even after all the maintenance and fuel savings, the TCO would be far more than an internal combustion engine vehicle. Retrofitting has several issues; firstly, one needs to pay full price for the ICE vehicles before even beginning electrification. To illustrate, consider the Pon-CAT 323F Z-line electric retrofit from 2018. IDTechEx estimates that the basic 26-tonne excavator would cost in the region of $250k. On top of this, an electric powertrain (motors, power electronics, software) is needed for around $165k, plus the labor of retrofitting, which IDTechEx estimates would cost approximately $60k, and finally, the battery. Buying a single battery pack, even a reasonably large one, doesn’t give much leverage for negotiating lower prices. So, firms will be paying in the region of $500/kWh for the battery, for a 300kWh battery needed in these machines, which alone will come to $150,000. All costs considered, the $250k ICE excavator has grown to $625k for the retrofitted electric. The benefits of electric mean that nearly $40k should be saved through reduced maintenance, and a further $90k of fuel savings is possible, but that still leaves the operator nearly $250k out of pocket.

The equation changes when production is bought in-house by the OEMs. Firstly, the vehicle would be built from the ground up as electric, so there is no retrofitting labor. It could actually be cheaper for the OEM to build the electric machine as the system is simpler than a diesel engine. Then, it can be assumed that the cost of the power electronics minus the battery is roughly equivalent to an internal combustion engine. Again, this is likely giving a small advantage to the diesels. However, the OEMs will still need to add a large battery to the vehicle. OEMs building series production vehicles in the hundreds or thousands will have a better position to negotiate battery pricing. IDTechEx’s research and conversations with industry indicate that OEMs should be able to get prices down to $300/kWh. This still gives a battery cost of $90k for the vehicle, which will be borne by the customer, but with the reduced operational costs the customer should still find that they have saved some money over the vehicle’s lifetime

Simply knowing that an EV will give a return isn’t all that helpful, though; owners will want to know when they can expect to start seeing their investments paying off. This is highly dependent on the vehicle sizing and the amount that OEMs are paying for batteries. The table below shows how many years it will take to start seeing net savings compared to diesel vehicles based on fuel and maintenance savings in wheel loaders of various weights.

To make sure owners and operators start seeing a return on their investment before their vehicles reach end of life, IDTechEx’s report “Electric Vehicles in Construction 2023-2043”, finds that battery prices need to fall below $400/kWh. The good news is that OEMs should already be able to secure this sort of pricing when scaling to series production of electric construction machines.

It has taken the automotive industry the best part of a decade to grow a supply chain for electric components and get prices of lithium-ion batteries down. The construction industry can leverage the heavy lifting done by the automotive industry and quickly adopt electric powertrains through an already-established supply chain. Construction OEMs will have quick access to off-the-shelf motors and inverters. There is already an established, if slightly stretched, battery supply chain, and there is a population of workers experienced in vehicle electrification that didn’t exist 15 years ago. This is all to say that the transition to electric should be relatively simple for the construction industry; the only thing that needs to fall into place is battery prices.

Currently, it looks like the OEMs will be able to get batteries at a price that makes sense for a compelling TCO. But once the industry finds its feet and begins to scale, battery pricing could fall as low as automotive levels. If an OEM could build an EV with batteries at $100/kWh, owners could see a return on their investment in as little as 2-3 years. At this time scale, the switch to EV should be a no-brainer.

As well as battery prices falling, maintenance is another area where there is still untapped potential. Most current estimates are that EVs will give a 50% reduction in maintenance, but why not more? After all, EVs have only one moving part, so there isn’t much to maintain. The majority of the remaining maintenance needs will be for the existing hydraulic systems. Almost all EVs will be keeping heritage hydraulic systems so that owners and operators can keep using their existing accessories, making the transition to EVs simple. However, using an electric powertrain opens the possibility of using electric linear actuators instead which will almost eliminate maintenance as well as providing other benefits such as increased precision and increased efficiency. Another benefit is that the increased efficiency will help to get more endurance out of the battery. Once linear actuators are introduced, maybe on 2nd or 3rd generation vehicles, the return on investment will happen even sooner, and lifetime savings will be even greater.

Unfortunately, these cost savings and cheaper electric construction machines won’t transpire overnight. OEMs are currently growing their portfolio of first-generation products. Some companies like John Deere and CAT haven’t even got that far yet. It will likely take a couple more years for $300/kWh machines to come to market and a few years after that to get down to $100/kWh.

IDTechEx’s report “Electric Vehicles in Construction 2023-2043” reveals how electric vehicles will change the shape of the construction vehicle market with a 20-year forecast. It shows that the future is promising for EVs in construction, and with the amount of savings potential in fuel and maintenance, it could also be very lucrative for owners and operators.