Record year end order book and net cash: capacity for enhanced returns.

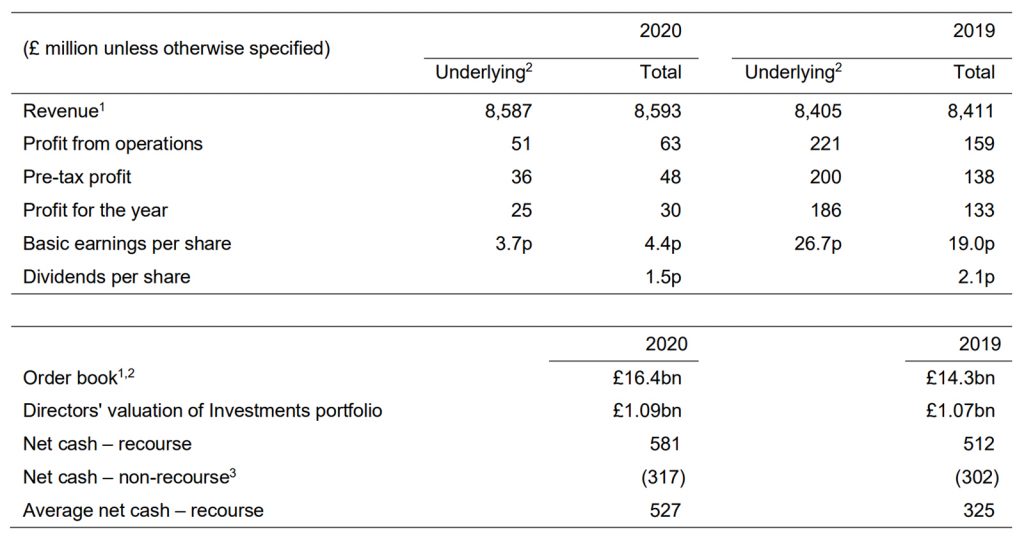

- Underlying profit from operations (PFO) at £51 million (2019: £221 million), after decision to repay UK Job Retention Scheme

- Strong cash performance with average net cash at £527 million (2019: £325 million), exceeding previous guidance

- Higher quality order book increased by 15% to £16.4 billion (2019: £14.3 billion); provides clear medium-term visibility

- Directors’ valuation of Investments portfolio stable at £1.1 billion (2019: £1.1 billion)

- New Group sustainability strategy with ambition to go beyond net zero carbon by 2040

- Re-iterating 2021 PFO outlook for earnings-based businesses to be in line with 2019

- Board recommended a final dividend of 1.5 pence, in accordance with new sustainable dividend policy

- Initial share buyback programme increased to £150 million in 2021, as part of new capital allocation framework

Leo Quinn, Balfour Beatty Group Chief Executive, said: “Throughout the pandemic, we have protected the Group’s strengths, supported our stakeholders and held firm to our disciplines. That we achieved this while exceeding our own targets for net cash demonstrates Balfour Beatty’s resilience and the dedication of our people and partners.

“Our leading positions in large growing infrastructure and construction markets, record year end order book and £1.1 billion Investments portfolio provide confidence in future cash generation. This underpins our new capital allocation framework which demonstrates Balfour Beatty’s commitment to deliver enhanced returns to shareholders.”

To read the announcement in full, please click here.