The Royal Institute of British Architects (RIBA) has published the latest Future Trends survey results, a monthly report of the business and employment trends affecting the architects’ profession.

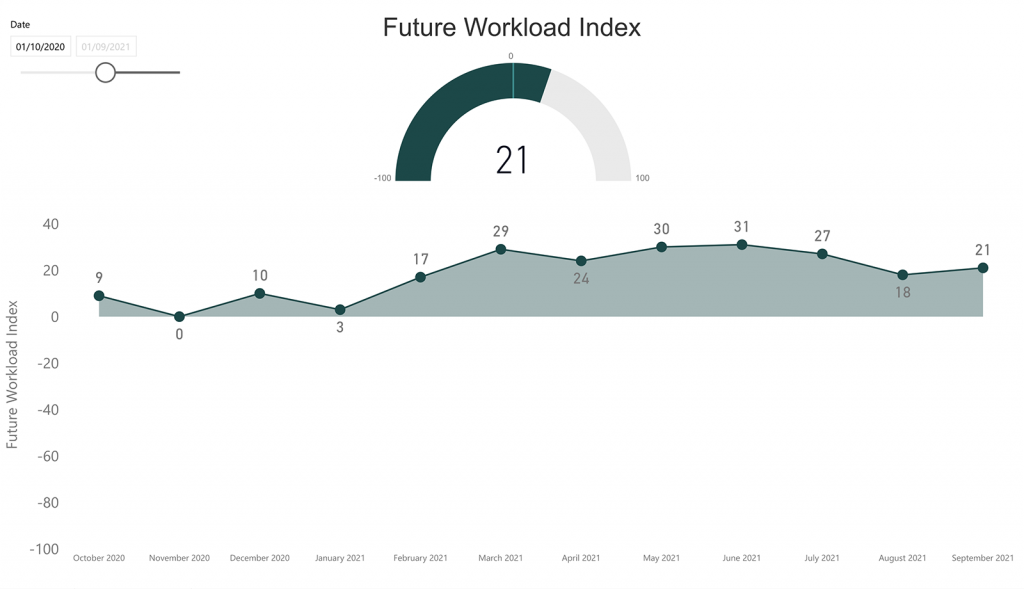

In October 2021 the overall RIBA Future Trends Workload Index remained in positive territory, with a balance figure of +15. However, this was a 6-point fall from September’s figure of +21 and 16 points lower than 2021’s June peak (+31). Looking ahead to the coming three months, 27% of practices expect workloads to grow, 61% expect them to remain the same and 12% expect workloads to decrease.

For the eighth successive month, all regions expect workloads to grow with several appearing particularly confident. The South of England posted a balance figure of +16 (up by 12 points) and the Midlands and East Anglia posted a figure of +14 (up by 11 points). But elsewhere, optimism was waning: London practices reported +8 (a fall by 18 points) Wales & the West +23 (down 5 points) and the North of England +20 (a fall of 21 points).

All four work sectors remained out of negative territory this month. The commercial sector rose slightly (with a balance figure of +12, up two points); the private housing sector posted a balance figure of +19 (a four-point fall from last month); and both the public and community sectors returned a balance figure of zero.

Confidence among medium (11 – 50) and large sized practices (51+ staff) remains strong, having risen to +47, up 13 points from +34 in September. Small practices (1 – 10 staff) also remain positive at +9, but their confidence has reduced slightly since September, and now sits at its lowest level since January 2021.

In terms of staffing:

- At +6, the RIBA Future Trends Permanent Staffing Index fell by four balance points in October.

- Overall, 10% of practices expect to employ more permanent staff over the coming three months, whilst 4% expect to employ fewer. 85% expect staffing levels to stay the same.

- With a combined balance figure of +24, expectations for staff recruitment remains highest among medium and large-sized practices (11+ staff), but small practices (1 – 10 staff) also expect staffing levels to increase, with a balance figure +2; 6% of them expect staff levels to increase while 4% anticipate a decrease.

- All regions said they anticipate the number of permanent staff to increase, although a lack of suitable, available candidates is holding back recruitment.

- This month personal underemployment also rose slightly (by three percentage points) to 15%.

RIBA Head of Economic Research and Analysis, Adrian Malleson, said: “Whilst architects remain optimistic about future workloads, confidence is becoming increasingly tempered in the face of external pressures.

“Shortages of materials, tradespeople, contractors and architects – for those seeking to recruit – are putting significant pressures and delays to the delivery of projects. This is fuelling project cost inflation, making estimating and managing project costs exceptionally challenging.

“Architects or contractors working on fixed-price contracts are increasingly at inflationary risk, and there is a growing concern that a prolonged period of general inflation may come, threatening the economic recovery, reducing overall confidence, and dampening client demand.

“Nevertheless, the near-term outlook remains strong for architects. The recovery continues and is broad-based, now extending from private housing to include the commercial sector too. Practices continue to report working at capacity and with full pipelines of future work.

“RIBA is reporting findings to government and working with other bodies in the built environment to monitor ongoing trends. We continue to be on hand, providing support and resources to our members.”